tax shield formula uk

The tax shield is a refundable tax credit that offsets a decrease in certain tax credits caused by an increase in your work income. Assume Case A brings after-tax income of 80 per year forever.

Effective Tax Rate Formula Calculator Excel Template

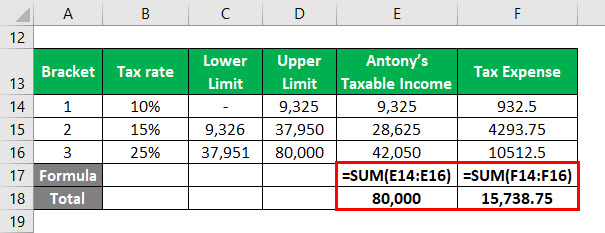

The incremental tax rate 15 on 28625 and 25.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

. The equity value increases from 40000 to 64000 because of the lower value of debt. Tax shields take different forms but most involve some type of expenditure that is deductible from taxable income. 44 0870 609 1918 charges may apply Email.

So keep in mind this number. The Pro-forma feature will carry your W-2s Schedule Cs 1099s and other important documents over from year to year. Sum of Tax Deductible Expenses 10000.

The calculation of interest tax shield can be obtained by multiplying average debt cost of debt and tax rate as shown below. For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. Effective Tax Rate 1967.

Interest Tax Shield 3500 2500 125100 Interest Tax Shield 109375. While tax shields are used for tax savings for both personal and business tax returns this article focuses on tax shields for businesses. The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate.

44 01384 563098 Sales. Since the cost of debt in this case is. In this case straight-line depreciation is used to calculate the amount of allowable depreciation.

If you see closely you will get to know the difference is all three tax rates. Interest Tax Shield Interest Expense Tax Rate. In this video on Tax Shield we are going to learn what is tax shield.

Your Account Your Basket. 44 0870 609 1918 charges may apply Email. Tax and accounts software for accountants tax specialists SMEs and business owners.

Do the calculation of Tax Shield enjoyed by the company. Tax Shield A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed. In terms of valuation assume the beneficial tax shield can be assumed by a new buyer.

We therefore assume that the firms WACC is 15 the borrowing rate is given above. Your Account Your Basket. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210.

Using the information entered Tax Shield intuitively generates a running database to calculate tax liability and determine the necessary forms for your client. This is equivalent to the 800000 interest expense multiplied by 35. Indicate the value of the tax shield b y W ACC.

Tax Shield Value of Tax-Deductible Expense x Tax Rate. A tax shield is a reduction in taxable income by taking allowable deductions. Calculating the tax shield can be simplified by using this formula.

Im effectively paying 52 million dollars after the tax break which means that yes my interest rate is 8 but after the tax break is. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. For more information about the tax shield see the following pages.

The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. Similarly the value of depreciation tax shield where depreciation is deducted from taxable income amount of depreciation x tax rate. Effective Tax Rate 1573875 80000.

Assume Case B brings after-tax income of 144 per year forever. WACC Formula Cost of Equity of Equity Cost of Debt of Debt 1-Tax Rate read more and assume that this proposal is already considered in the calculation of the weighted average cost of capital WACC. Or the concept may be applicable but have less impact if accelerated depreciation is not allowed.

The tax credit for childcare expenses the work premium and the adapted work premium are the tax credits affected by an increase in income. Interest Tax Shield Average debt Cost of debt Tax rate. Under this assumption the value of the tax shield is.

This reduces the tax it needs to pay by 280000. Interest bearing debt x tax rate. Value of firm after-tax income return of capital therefore.

Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒. The following is the Sum of Tax-deductible Expenses Therefore the calculation of Tax Shield is as follows Tax Shield Formula 10000 18000 2000 40. A tax shield is a way to save cash flows and increases the value of a firm.

Stated another way its the deliberate use of taxable expenses to offset taxable income. The value of these shields depends on the effective tax rate for the corporation or individual. Tax Shield 10000 40 100 Tax Shield 4000.

Based on the information do the calculation of the tax shield enjoyed by the company. Using the above examples. Tax Rate 40Tax Shield Sum of Tax Deductible Expenses Tax rate.

Larger than the riskless rate we will end up with a. The tax rate on every bracket is the statutory tax rate. As such the shield is 8000000 x 10 x 35 280000.

Or after tax Im paying 52. T ax Shields in an LBO page 8. The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction.

Im paying 8 million dollars in interest I get a tax break of 28. Common expenses that are deductible include depreciation amortization mortgage payments and interest expense. Example of the.

Interest Tax Shield Formula. 44 01384 563098 Sales. Tax and accounts software for accountants tax specialists SMEs and business owners.

Then when you sell the house your equity value is increased by the subsidy on interest payments. In addition the effective leverage has declined.

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Colour Shield Glow Luminizing Body Enhancer Pearl Body Makeup Even Out Skin Tone Glow

Mitch Evans Sparkjaguar Jaguar Itype On Track During The New York City Eprix Tenth Round Of The 2016 17 Fia Formula E Series On J Formula E Formula Sponsorship

Taxable Income Formula Calculator Examples With Excel Template

Unlevered Free Cash Flow Definition Examples Formula

Wacc Diagram Explaining What It Is Cost Of Capital Financial Management Charts And Graphs

/dotdash_Final_EBITDA_To_Interest_Coverage_Ratio_Dec_2020-012-3a127232967d435d93bda56dd6b7211f.jpg)

Ebitda To Interest Coverage Ratio Definition

Effective Tax Rate Formula Calculator Excel Template

Capital Gain Formula Calculator Examples With Excel Template

Power Over Someone Who Has Wronged You By Geoffrey Martel Etsy Uk Spelling Occult Books The Magicians

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)